When it comes to building a fulfilling family life, one crucial factor stands out: the significance of “Building a Strong Financial Foundation for Your Family”. A strong financial foundation not only brings peace of mind but also paves the way for achieving your family’s dreams and aspirations. In this article, we will delve into the importance of financial stability for families, explore the basics of budgeting, saving, and expense management, and provide practical tips for setting financial goals and creating a family budget. Let’s embark on a journey towards securing your family’s financial future.

The Significance of Financial Stability

Financial stability is like the cornerstone of a house; it provides a solid base upon which your family can thrive. It’s not just about having money—it’s about having the confidence and ability to navigate life’s challenges, whether planned or unexpected. A stable financial foundation offers peace of mind, reduces stress, and empowers you to make choices aligned with your family’s values and goals.

Understanding Budgeting

The Basics of Budgeting

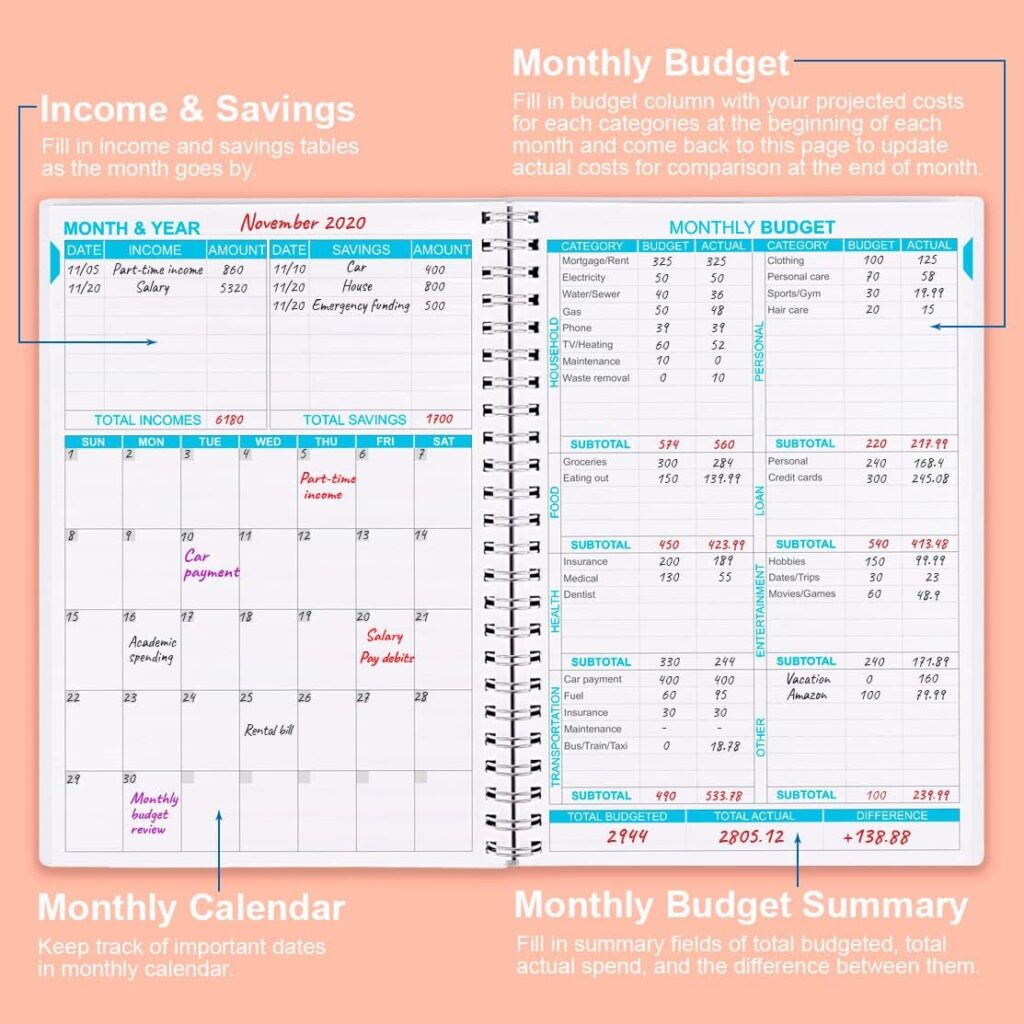

Budgeting is the fundamental building block of financial stability. It involves tracking your income and expenses to ensure that you are living within your means. Begin by listing all sources of income and categorizing your expenses, including necessities like housing, utilities, groceries, and discretionary spending.

Setting Financial Goals

Financial goals give your family a sense of purpose and direction. Whether it’s saving for a family vacation, buying a home, or funding your children’s education, goals provide motivation for disciplined financial management. Break down larger goals into smaller, actionable steps to make them more achievable.

Creating a Family Budget

Unveiling the Power of a Family Budget

A family budget serves as a roadmap for your finances. It outlines how much you can allocate to various categories and helps identify areas where adjustments are needed. Make sure your budget reflects your family’s priorities and values.

Tips for Effective Budgeting Techniques

- Track Your Spending: Monitor your expenses to identify spending patterns and areas where you can cut back.

- Emergency Fund: Set aside a portion of your income for emergencies. This safety net provides peace of mind during unexpected financial challenges.

- Debt Management: Prioritize paying off high-interest debt to reduce financial strain over time.

- Regular Review: Review and adjust your budget periodically to accommodate changes in income or expenses.

The Importance of Saving

Instilling a Savings Mindsetndset

Savings are the cornerstone of financial preparedness. Teach your family the value of saving by setting an example and involving everyone in the process. Encourage children to save a portion of their allowance, fostering healthy financial habits from a young age.

Types of Savings

- Short-Term Savings: Allocate funds for upcoming expenses like vacations, holidays, or home repairs.

- Long-Term Savings: Save for major life events such as buying a home or funding retirement.

- Education Savings: Set up accounts to save for your children’s education expenses.

Preparing for Life’s Twists and Turns

The Role of Insurance

Life is unpredictable, and that’s where insurance comes in. Health insurance, life insurance, and disability insurance safeguard your family’s well-being in times of need. Having the right coverage ensures that unexpected medical expenses or unfortunate events don’t derail your financial plans.

Estate Planning

While it may seem distant, estate planning is an essential part of securing your family’s future. Create a will, designate beneficiaries, and outline your wishes for your assets. Estate planning provides clarity and minimizes potential legal complexities for your loved ones.

As you journey towards ‘Building a Strong Financial Foundation for Your Family,’ remember that financial stability forms a cornerstone that cannot be overlooked. By understanding the importance of budgeting, setting financial goals, and embracing the habit of saving, you are well on your way to achieving your family’s aspirations. Remember that financial preparedness empowers you to navigate life’s challenges with confidence and grace. As you build your strong financial foundation, you’re not only securing your family’s future but also ensuring a legacy of financial wellness for generations to come